Have you thought about your retirement plan today? Are you going to travel the world, check off your bucket list, or will you spend your time relaxing with your family? But wait – How are you going to sustain your lifestyle after you stop working?

Your retirement doesn’t have to be full of financial strife. Many companies offer packages that will help you set yourself up for retirement bliss. Here is everything you need to know about 401K’s and how they can help you prepare for financial freedom in retirement.

What is a 401(k)?

A 401(k) is an employer sponsored retirement savings plan. With a 401(k), an employee can invest a portion of their paycheck and put into an investment portfolio that consists of stocks, bonds and money market investments.

There are two types 401(k)’s – a Traditional 401(k) and a Roth 401(k). The Traditional 401(k) is more common with the Roth 401(k) being far less common. Let’s break down the differences between the two:

Traditional 401(k)

In this type of 401(k), the portion of your paycheck that you contribute to your plan is pulled before taxes are taken out. This causes the taxable income in each paycheck to drop. However, when you finally withdraw money from this type of plan, taxes will be taken out at the time of withdrawal.

There are a few additional withdrawal rules for this type of 401(k). Unless you leave your employer at age 55 or older, you don’t have access to your funds before age 59 ½. If you do dip into your plan early, you will have to pay a 10% penalty fee in addition to the taxes that will be taken out upon withdrawal.

Roth 401(k)

For this 401(k) plan, your contributions are made with wages that have already been taxed. While this does mean that your taxable income doesn’t change, you won’t have to pay taxes when you withdraw from your 401(k) plan.

Also, you have more flexibility and access to your money. As long as you’ve held the account for 5 years or more, you can withdraw from your account without paying a penalty fee.

How much money should I invest?

Every person’s situation is different, but you should invest as much as you can afford. Experts suggest trying to invest at least as much as your employer matches. The national average is about 3%. So you want to invest at least 3% of your income. If you don’t, you leave free money on the table.

Note, there are some limitations as to how much you can invest. In 2018, you can only invest up to $18,500 or $24,500 if you’re over the age of 50.

Most companies will hire an administrator and/or advisor like Voya, Fidelity Investments or Morning Star that will help you set up and manage your account. They can even forecast how much money you will have saved up depending on how much you invest while looking at market trends!

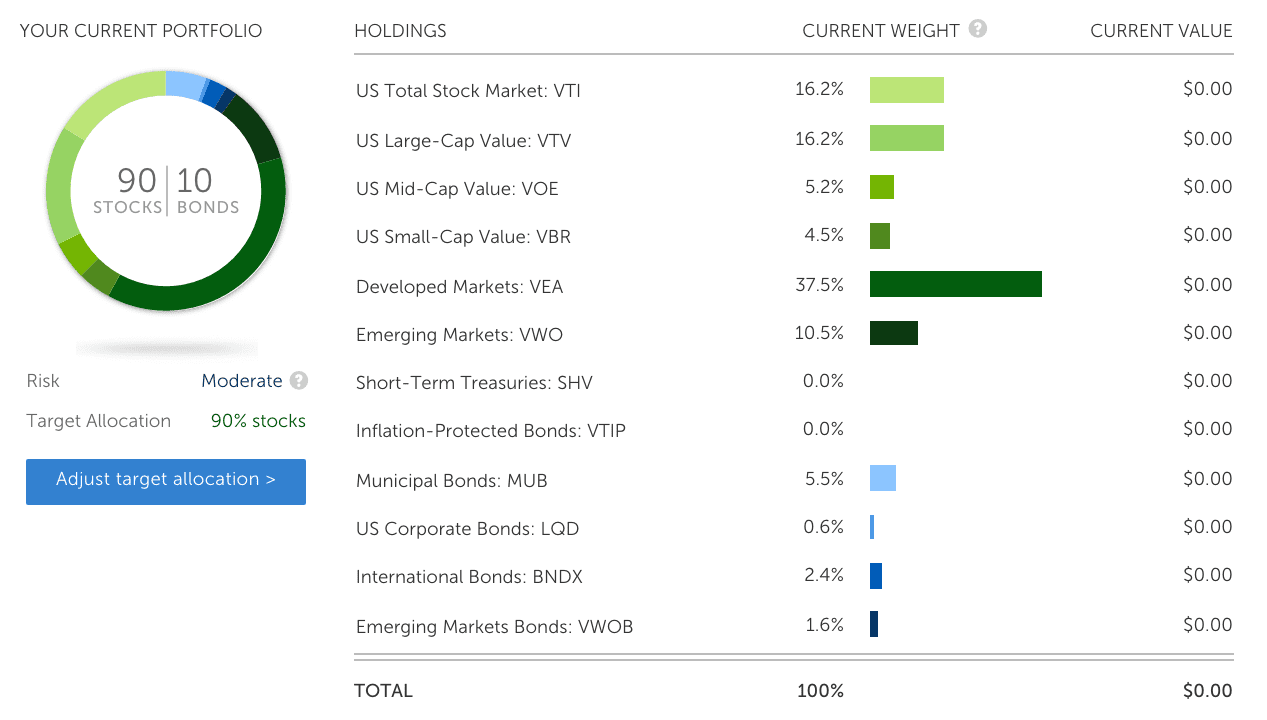

Where should I invest my money?

An advisor, like Morning Star, can pick out accounts for you to invest your money in based on how much risk you want to take. Ultimately, you make the final decision on where to invest your money.

In theory, the closer you are to retirement, the less risk you want to take. Riskier or more volatile accounts can bring big payouts or cause major losses, and you wouldn’t want to lose a large chunk of your income right as your about to start depending on it.

.png)

I just had to leave a company or my place of employment went under, now what?

First off, take a deep breath! Your money is safe and is still yours – NO MATTER WHAT!

In most cases, if you are asked to leave a company, let go or if a company closes or is bought out, you will have to move your money into a different account.

If your company is bought out, the new owner(s)/business will help you roll your accounts over into their offered 401(k) plans.

If you’re let go or if the company goes under, you can either cash out your plan, move it into a different 401(k) or into what is called a Traditional IRA.

A Traditional IRA is very similar to a 401(k) in that it is a retirement savings plan. The only difference is this is sponsored by an individual, like yourself, versus an employer.

Remember, if you choose to cash out your 401(k) – you must be prepared to pay that 10% penalty fee for dipping into it early.

No matter which option you choose, the administrator for your employer’s 401(k) should be able to help you fill out any paperwork you need.

I’m not eligible for my company’s 401(k). What do I do?

Don’t worry! This is really common! Some companies, especially smaller companies, require you to work with them for at least a year before you can set up a 401(k) plan with them. Delayed enrollment into your company’s 401(k) plan doesn’t mean you can’t start saving for your future now!

Traditional IRA

The Traditional IRA mentioned earlier is always an option! There are only two requirements to be eligible for an IRA: (1) You have to have received earnings from work during the year and (2) Be under the age of 70 ½.

Just like a 401(k), there are limits to how much you can contribute to an IRA. For 2017, an individual could contribute up to $5,500 dollars and $6,500 if you’re 50 or older, but you cannot contribute more than your taxable income for that year. The income that you contribute comes from your paycheck before taxes, just like a 401(k). So, again like a 401(k), you’ll have to pay taxes when you withdraw from it.

Open a Brokerage Account

With a brokerage account, you work with a licensed brokerage firm, like Charles Schwab Brokerage, or with a discount brokerage account, like E*Trade, to help you make investments in the stock market. With the money you invest, you buy and sell stock to increase your investments and therefore your retirement fund!

Save More

One easy way to build a small retirement fund is to save money. If you have a little money left over at the end of the month, put it into a separate account and don’t touch it. Banks have different accounts that will help that money grow as time goes on. This is not the most effective way, but every little bit helps until you can crack into that 401(k)! If you need help saving money, get some tips and tricks here!

%20Blog%20Image%20(1).png)

-400x250.png)