For any business, staying on top of market changes and economic shifts is vital for staying competitive. An often overlooked area of economic change is the cost of living (COL).

Every community, big and small, has a calculated cost of living that reflects the unique cost of goods, services, and taxes in that area. That cost impacts things like real-estate prices, welfare, and wages. It also is a helpful number to track and understand the larger impact of inflation, something most businesses are very aware of, particularly in the last year.

A proactive company can combine several metrics to inform their wages and benefit offerings, COL and Inflation in particular. Employees in Atlanta, GA versus Evans, GA require different sums to cover the same goods and services, so they must be paid in accordance with their area’s unique COL.

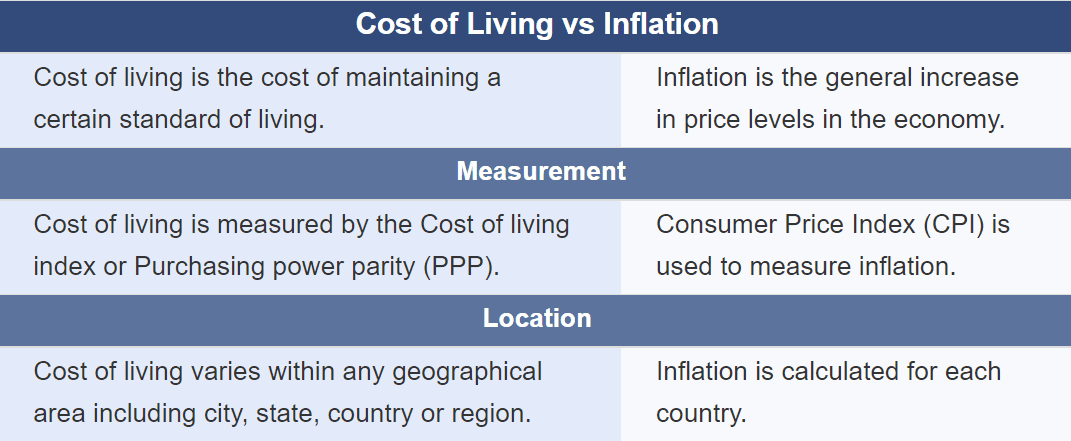

So, What’s the Difference Between Inflation and Cost of Living?

The critical difference between the cost of living and inflation is that “cost of living is the cost of maintaining a certain standard of living whereas inflation is the general increase in price levels in the economy.”

Differences in cost of living can also be measured in purchasing power parity rates. Reduction in purchasing power is the main consequence of inflation.

Why are Cost-of-Living and Inflation Relevant to your Business?

The current job market is more competitive than ever, and job-seekers are demanding higher wages and increased benefits. Retention rates are plummeting, and labor participation rates have remained stagnant since the onset of the pandemic. Businesses can utilize Cost-of-Living data and inflation trends to inform their wage policies and attract new talent and retain current talent.

Wages should not only sustain workers within their community’s current economic state but continuously adapt to ensure employees remain supported, regardless of market fluctuations. As inflation and COL increase, so should wages, lest the current market repeats itself in the future.

Employees crave a conscious employer that considers what the employee can do for them, and what they can do for the team member and their community. Demonstrating economic literacy and using that to inform policy change is a key component of attracting and retaining desirable talent.

How can a Partner Help?

Every business has its own unique specialty: its core. For your business that may be manufacturing, logistics, or energy and utilities. For others, it’s building an agile, capable workforce. It just makes sense to partner with a business that’s skilled at compiling and analyzing things like wage data, market trends, and applicant flow when you’re vying for a competitive edge in this difficult market.

Determining the best wages to attract your ideal candidate can be tricky, especially when you factor in COL and Inflation trends. A trusted partner can help you put your best foot forward and establish your business’s reputation as a conscientious, proactive employer.

The market has experienced significant workforce changes over the last few years. Learn how a Part-Time model could help navigate extreme demand fluctuations.